Credit score alone does NOT equal a loan approval

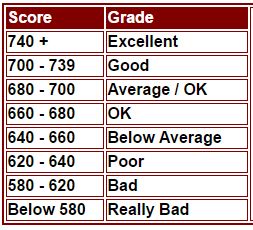

With a score below 580, your odds are very slim, and most people really should save themselves the hassle. Stop attempting to find mortgage loans, and work on improving your scores instead. Once you have achieved a 620 or higher score, you should be in much better shape.

CREDIT PROBLEMS & ANSWERS

Late Payments

If your credit has

multiple RECENT 30,

60, or 90-day late payments, you

probably won't qualify. Especially if those late payments occurred LESS THAN

than two years ago. Lenders want a clean

recent payment history.

Collections, Judgements, and Tax Liens

If

your credit history indicates unpaid collection accounts, most "A" grade loan

lenders will require these amounts to be paid off before the

loan is funded. FHA typically will ignore them if they are under $2000, and more

than 2 years old. Medical collection "usually" are ignored. Judgments' (you got

taken to court & lost), are always REQUIRED to be paid off before you can get a

mortgage loan.

Bankruptcy

If your bankruptcy is more than 2-year old, you can usually be approved for an FHA loan with as little as 3.5% down.

If your chapter 7 bankruptcy is older that 4-years, and you have good re-established credit, you may now qualify for an standard conforming loan.

If your chapter 13 bankruptcy is 2-years after discharge date and you have good re-established credit, you may now qualify for an standard conforming loan.

If your chapter 7 bankruptcy is 2-years after discharge date and you have good re-established credit, you may now qualify for a VA loan.

If your chapter 13 bankruptcy has at least 1-year of on time payments, you may now qualify for a VA loan.

If your chapter 7 bankruptcy is 3-years after discharge date and you have good re-established credit, you may now qualify for a USDA Rural Development Loan.

If your chapter 13 bankruptcy has at least 1-year of on time payments, you may now qualify for a USDA Rural Development Loan.

ForeclosureIf your foreclosure Sheriff Sale Date is OVER 7-years old, you may qualify for a standard conventional loan.

If your foreclosure Sheriff Sale Date is OVER 3-years old, you may qualify for an FHA loan with as little as 3.5% down payment.

If your foreclosure Sheriff Sale Date is OVER 2-years old, you may qualify for a VA Loan with Zero Down Payment.

If your foreclosure Sheriff Sale Date is OVER 3-years old, you may qualify for a USDA Rural Development loan with Zero Down Payment.

Short-Sale or Deed in LieuIf your short-sale date is more than 4-years old, you may qualify for a conventional loan

NO waiting period after a foreclosure for an FHA Loan if you had NO late payments on ANY mortgage or consumer debt in the 12-months proceeding the short-sale AND it was NOT a strategic short sale.

If your short-sale date is more than 3-years old, you may qualify for an FHA Loan loan

If your short-sale date is more than 2-years old, you may qualify for a VA Loan with zero down payment

If your short-sale date is more than 3-years old, you may qualify for a USDA Rural Development loan with zero down payment

Cambria Mortgage - St Paul Office

33 Wentworth Ave E, Suite 290

St Paul, MN 55118

Office (651) 552-3681

Fax (651) 994-6425

E-Mail: joe.metzler@cambriamortgage.com

FHA,

VA, and USDA Approved Lender

We are an Approved Lending Institution

for FHA, VA, and USDA Government Loans. While

we are an approved lender, we are not part of HUD, FHA, the Veterans

Administration or the United States Department of Agriculture. We are not acting

on behalf of, or under the direction of HUD/FHA, VA, USDA, or the Federal

Government in any way. FHA and VA do not lend directly to the public, only

through approved lending institutions like Cambria Mortgage.

License Information

Cambria Mortgage. Nationwide Mortgage Licensing System and Registry (NMLS)

# 322798 Saint Paul Branch - NMLS # 387944. Joe Metzler, Licensed Mortgage Loan Originator NMLS # 274132.

Lending in MN, WI, IA, ND, SD,CO, FL

only.

Equal Housing Lender © 1998 - 2024 - Joe Metzler for Cambria Mortgage